Building profits

The construction industry is one of the most volatile sectors in the UK economy, and careful planning and advice are needed to maintain efficiency and competitiveness. With years of experience in this sector, we pride ourselves on having an understanding of the specific problems faced by builders, building and civil engineering contractors, and civil engineering consultants, and in being able to recommend effective solutions.

We work with you to help you optimise your performance through advice on appropriate funding, project planning, cashflow planning, payroll services, etc. We guide you through the maze of regulations imposed on the industry, help you to minimise your compliance costs, and help you to build a successful future.

Contact Us today to discuss how we can help you build a more profitable business.

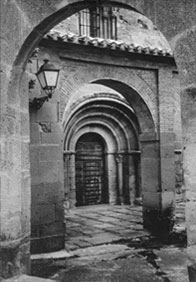

In the 11th and 12th centuries half a million pilgrims a year travelled on foot from all over Europe to Santiago de Compostela in northern Spain. In September 1992 Patrick Shanahan retraced their steps, recording his 500 mile journey in a series of photographs, some of which are reproduced on this website.